VITA

Volunteer Income Tax Assistance

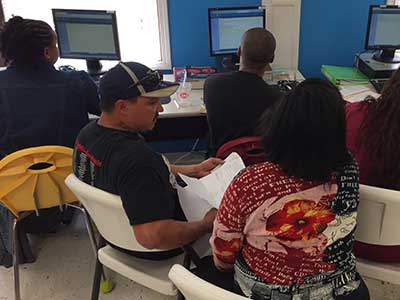

STEP provides free tax preparation services for families and individuals earning less than $60,000 annually. Trained and certified volunteers prepare most standard IRS documents (i.e. 1040, 1040EZ and 1040A) and submit all returns electronically. Volunteers help clients take advantage of the Earned Income Tax Credit (EITC), Child Tax Credit, and more.

We offer assistance at the STEP offices in Rocky Mount and Stuart beginning in January and ending in April. All of these services are free, which means you get to keep more of your money! STEP’s VITA program saves our clients an average of $200 in tax preparation fees each year. That means that last year, our clients collectively saved more than $120,000 in fees!

Those who want to prepare their tax returns need to bring a picture ID, social security cards for all tax payers and dependents, and all tax related documents such as W-2. They should also bring a copy of their last year’s tax return if possible.

Testimonial

The VITA program through STEP helped me with my 2022 taxes. It was a complicated year with many deductibles that needed to be itemized. Thank you for making this easier!

-A Happy Client

Learn More

Our VITA tax program for the 2024 TAX YEAR is opening January 28, 2025. Blank tax packets will be available for pick up at both STEP offices starting January 22, 2025.